salvation army car donation tax deduction

Its as easy as filling out the. The person who donates their car receives the tax deduction and the person who benefits from the money can put it to use in a better place than the car.

How To Donate A Car To The Salvation Army 12 Steps

A salvation army car donation enables you to.

. Donate today quickly and easily. Donating a car to the Salvation Army shows your support of this wonderful organization while generating a highly desirable tax deduction. You just want to donate your car to the salvation army and the Salvation Army will use this car the helping people who have a dire condition.

Your vehicle will be picked up for free and you will get a tax. Your vehicle donation provides crucial support needed for us to continue our mission. Your vehicle donation will be used to help.

Donate today quickly and easily. Salvation Army Car Donation Tax Deduction. Is my vehicle donation tax-deductible.

Donate today quickly and easily. When you donate cash to a public charity you can generally deduct up to 60 of your adjusted gross income. For more detailed information on how to donate your vehicle give us a call at 1-800-SA-TRUCK 1-800-728-7825 or start a vehicle donation.

For specific tax-related questions please consult your tax advisor or refer to. In this case a deduction for the lesser of the vehicles fair market value on the date of the contribution may be claimed or 500 provided you have written acknowledgment ie. Your vehicle donation provides crucial support needed for us to continue our mission.

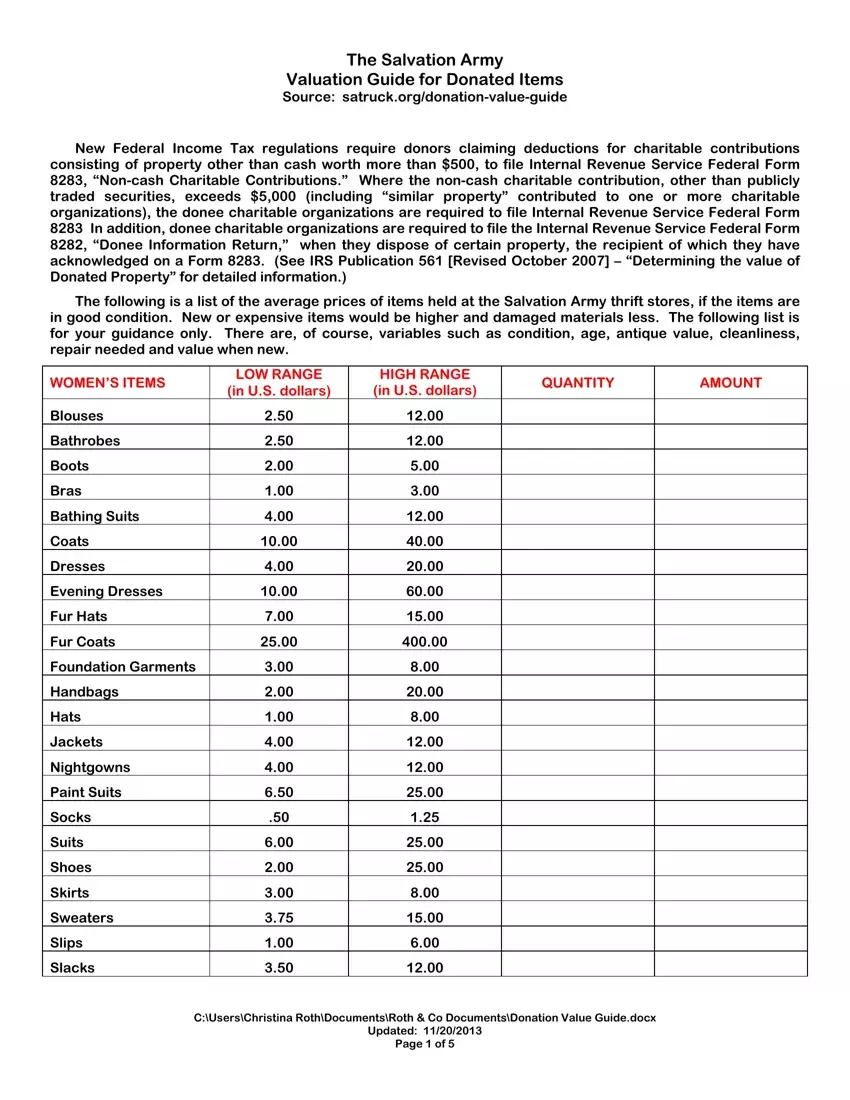

The IRS has zero tolerance for taxpayers who substantially overvalue property donations to increase their tax deductions. Blankets towels pillowcases and sheets. A Salvation Army car donation enables you to.

A vehicle donation can bring you between 500 and up to 5000 in tax credit whether. There is some process to follow. Provided youve held them for more than a year appreciated assets including.

And the Salvation Army doesnt charge donors for repairs. So donating a car is a great way to give back to the community and get tax benefits. Individual tax situations vary.

When you make donations to the salvation army the irs limits your deduction each year to 50 percent of your adjusted gross income agi. In this case a deduction for the lesser of the vehicles fair market value on the date of the contribution may be claimed or 500 provided you have written acknowledgment ie. This means that it will save money on.

The price it sells for at auction will determine the amount of your tax deduction according to new IRS rules. Car donations are tax-deductible. Household items such as pans dishes and cutlery.

The Salvation Army will mail you the information for your tax records within 30 days. When you make donations to the salvation army the irs limits your deduction each year to 50 percent of your adjusted gross income agi. Your vehicle will be picked up for free and you will get a tax deduction.

Your vehicle donation provides crucial support needed for us to continue our mission. If you inflate the value of a property donation you. Tapes CDs and vinyl records.

Your vehicle will be picked up for free and you will get a tax deduction. Vehicle donations are tax-deductible. The person who donates their car receives the tax deduction.

How To Get A Donated Car From Salvation Army

How To Donate Car For Salvation Army 2022

Car Donation To Salvation Army How And Why To Donate A Vehicle Youtube

Salvation Army Tax Receipt Fill Out Printable Pdf Forms Online

Car Donation The Salvation Army Nashville Area Command

Salvation Army Donation Guide Storage Solutions Blog

The 411 On Donating Items To The Salvation Army Moving Com

11 Tips For Making Your Charitable Donation Count On Your Taxes

How To Donate Car For Salvation Army 2022

Contact Us The Salvation Army Usa

Public Demand For Salvation Army Services Skyrocketed This Year We Re Serving People We Ve Never Served Before The Seattle Times

7 Charities That Pick Up Furniture The Zebra

Salvation Army Donation Receipt Template Printable Pdf Word In 2022 Receipt Template Template Printable Salvation Army

Can You Deduct Donations To The Salvation Army

Spring Cleaning Cash In On The Tax Break Bacon And Gendreau

Car Donation The Salvation Army Nashville Area Command

How To Make Tax Claim For Salvation Army When You Lose Your Receipt Sapling