when will capital gains tax increase in 2021

The current tax preference for capital. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth.

. The State has appealed. Capital Gains Tax Rate. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. This news is not surprising but it rather buries the lede. The British economy which suffered under the COVID-19 pandemic has been propped up by the furlough scheme.

Special cases for taxation. Last years tax gains. Partner with Aprio to claim valuable RD tax credits with confidence.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after. The top rate would be 288 when. In 2021 and 2022 the capital gains tax.

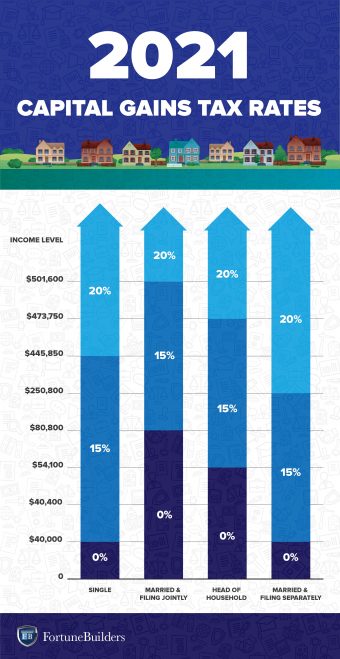

There are seven federal income tax rates in 2023. Capital Gains Tax Rates 2021 To 2022. 13350 of the qualified dividends and long-term capital gains 83350 70000 is taxed at 0.

Long-term capital gains tax rates for the 2022 tax year In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. Will the capital gains tax rates increase in 2021. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The maximum zero rate amount cutoff is 83350. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

1 day agoThe measure adds a 7 tax on capital gains above 250000 a year such as profits from stocks or business sales. Its time to increase taxes on capital gains. Ad If youre one of the millions of Americans who invested in stocks.

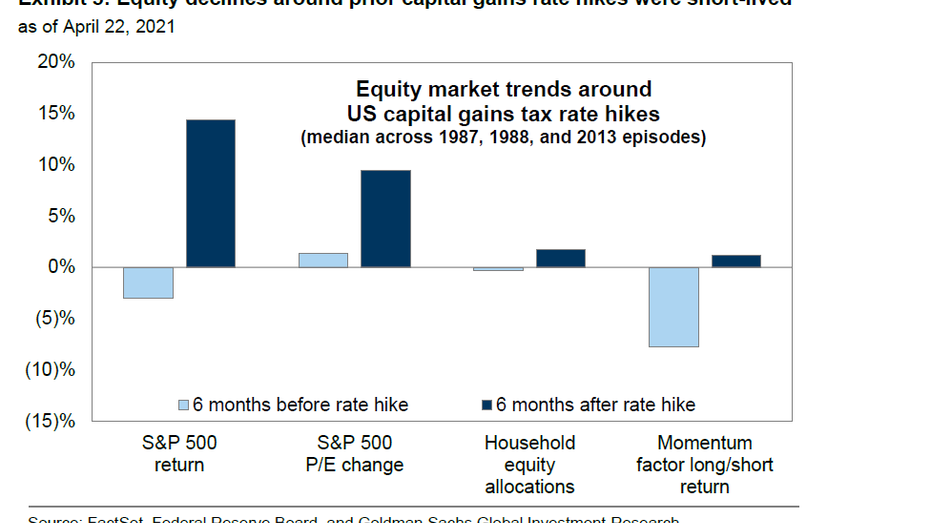

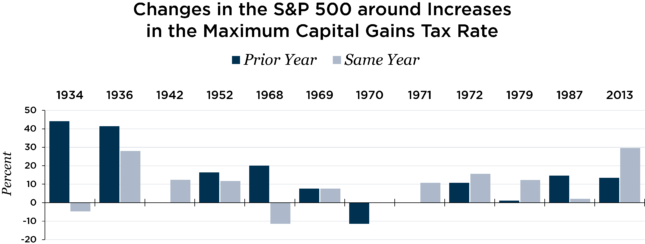

A similar threshold exists on the upper end for qualified. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains. Capital gains tax increase unlikely to deter investors.

Posted on January 7 2021 by Michael Smart. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

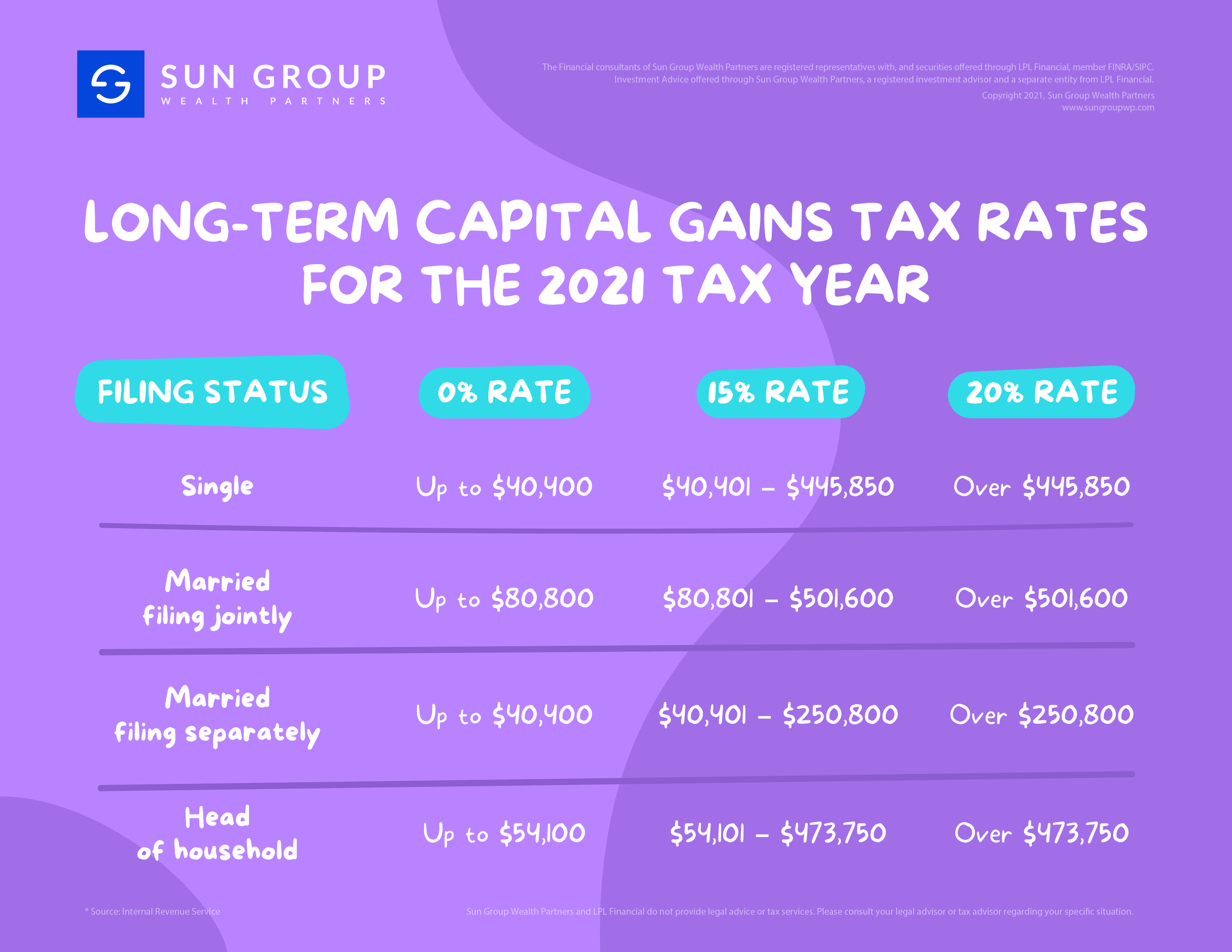

What will the capital gains rate be in 2022. For long-term capital gains thats a potential increase of up to 196 over the current maximum tax. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

However it was struck down in March 2022. Its time to increase taxes on capital gains. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Your 2021 Tax Bracket To See Whats Been Adjusted. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. The effective date for this increase would be September 13 2021.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Capital gains tax is likely to rise to near 28 rather than 396.

2022 capital gains tax. Note that short-term capital gains taxes are even higher. For months now there has been speculation that capital gains tax rates will go up in the forthcoming Budget.

The rate jumps to 15 percent on capital gains if their income is 41676 to 459750. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. This included the increase of GT rates so they were more similar to.

The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. 2021 Longer-Term Capital Gains Tax Rate Income Thresholds. Exceptions include the sale of real estate livestock and small family-owned businesses.

To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 2021 capital gains tax calculator.

Apr 23 2021 305 AM. Capital Gains Tax Rates Brackets Long-term. The remaining 20000 13350 6650 is taxed at 15.

In May 2021 former state Attorney General Rob McKenna filed a. The lifetime capital gains exemption is 892218 in 2021 up from 883384 in 2020. Ned Lamonts adjusted gross income was 54 million in 2021 a nearly seven-fold increase over the previous year driven by 527 million in capital gains according to tax records released.

Connect With a Fidelity Advisor Today. A Retroactive Capital Gains Tax Increase. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Short Term Vs Long Term Capital Gains White Coat Investor

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

Crypto Capital Gains And Tax Rates 2022

Capital Gains Tax Hikes And Stock Market Performance Fox Business

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

Stocks Retreat On Capital Gains Plan Nationwide Financial

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Real Estate Capital Gains Tax Rates In 2021 2022

Long Term Capital Gains Tax Rates For The 2021 Tax Year Sun Group Wealth Partners

Carl Quintanilla On Twitter Correlation Between Capital Gains Tax And Market Returns 1968 2021 Via Johnspall247 Https T Co Gkocg8xlrw Twitter

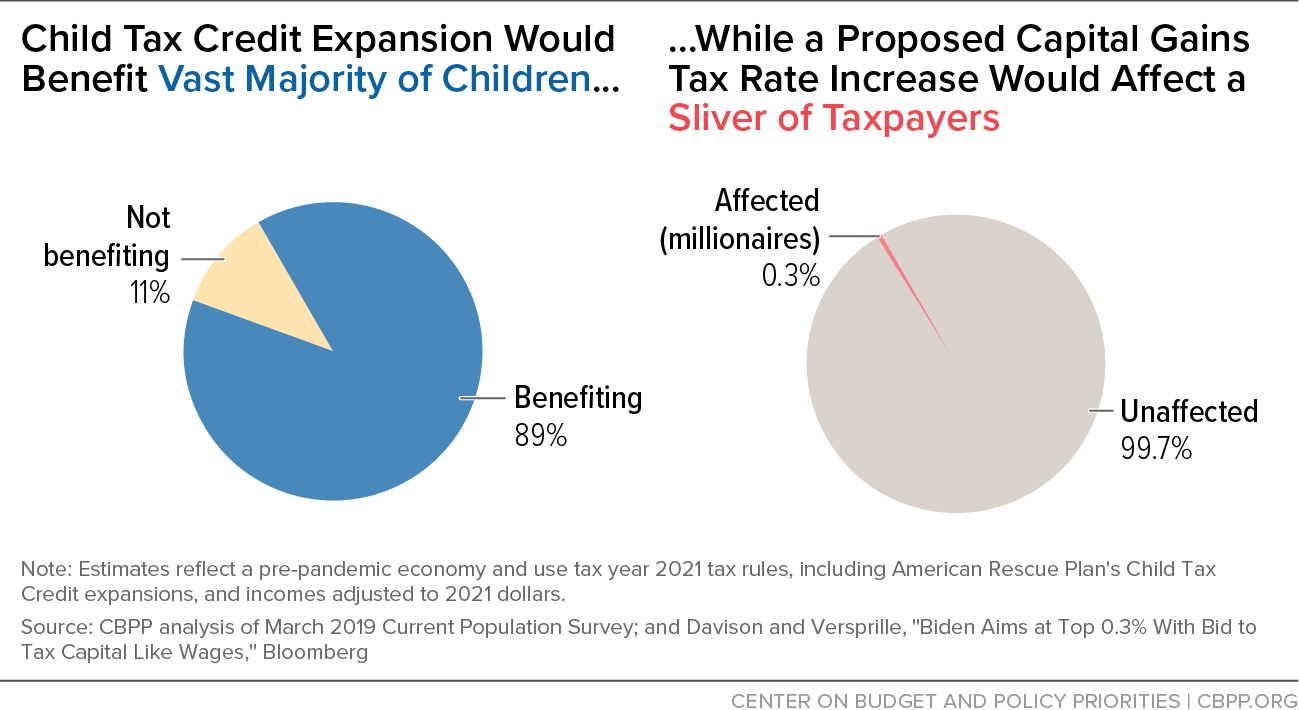

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

What S In Biden S Capital Gains Tax Plan Smartasset

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

Biden Capital Gains Tax Rate Would Be Highest In Oecd

House Democrats Capital Gains Tax Rates In Each State Tax Foundation