sports betting in ct taxes

Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. Whats happening in CT sports betting right now.

Online Sports Betting Is Live In Connecticut Ctinsider

Complete Edit or Print Tax Forms Instantly.

. The legalization of sports betting in Connecticut State is close and soon people will be able to visit physical sportsbooks to place their wager. 7 hours agoOctober 4 2022 at 1027 am. 1 day agoNumbers recently released by the Virginia Lottery show 45 million in sports betting-related tax was paid to the state in August up from 31 million collected in July and 14.

The IRS code includes cumulative winnings from. 12000 and the winners filing status for Connecticut income. Any sports betting earnings that go beyond 600 are expected by the IRS to be reported by the gambler when they file their taxes.

Legal Connecticut sports betting takes place online and in person. The IRS taxes winnings differently whether you are a casual bettor or in the trade and business of gambling. Proceeds will go to a college fund to allow students to attend.

The legal gambling age in Connecticut is 21 and this is likely to apply to retail and online sports betting. Winnings From Online Sports Sites Are Taxable. Those numbers will increase with.

Sports betting tax rate. A new poll shows both statewide ballot measures to legalize sports betting in California losing badly with likely voters and a proposed new tax on. Ad Download Or Email CT-706 NT More Fillable Forms Register and Subscribe Now.

New Customers Get up to a 1000 Deposit Bonus With DraftKings Today. CT Sports Betting Taxes. In the world of gambling there is only one certainty.

Tax payments from sports betting operators in February were the lowest yet. The state taxes sports betting revenue each month from three master licensees. Ad Bet Online From Anywhere in Connecticut With DraftKings.

You must be 21 years of age to participate in casino games but then again. 19 2022 Connecticut saw 80 million bet in August across its three mobile sportsbooks and retail CT Lottery. 12000 and the winner is filing.

The tax revenue gained through regulated sports betting is the primary reason behind its legalization. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. The state will collect.

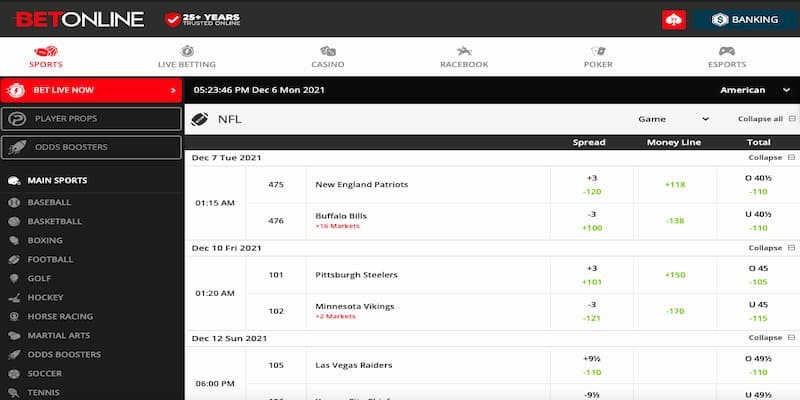

Ad Hundreds Of Ways To Bet Including Props Same Game Parlays In-Game Betting More. If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income. How much revenue will CT sports betting generate.

New Customers Get up to a 1000 Deposit Bonus With DraftKings Today. Learn about CT betting laws the best legal sportsbooks promo codes bonuses and news. Ad Bet Online From Anywhere in Connecticut With DraftKings.

Sign Up Now To Bet On Todays Top Sports Events. Since PASPA was repealed by the Supreme. See Live And Boosted Odds And Bet Online.

Sports betting is expected to bring in about 19 million in the first year and 23 million in tax revenue in the second year of the budget. How the IRS Taxes Sports Betting Winnings. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

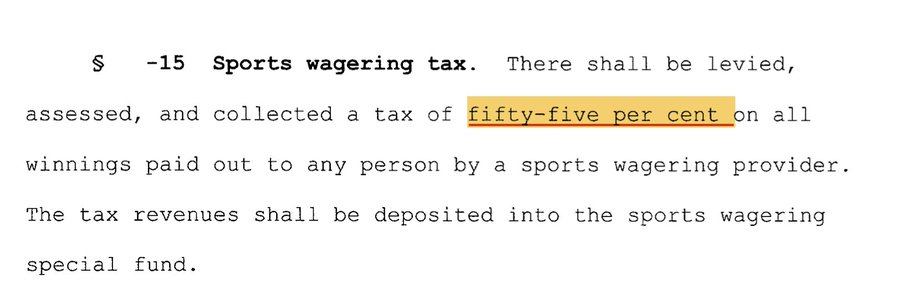

When sports betting becomes legal in the state. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. Any unpaid taxes will accrue interest.

The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24.

FanDuel and DraftKings now enjoy a duopoly in Connecticut with Yahoo exiting the state marketplace in response to a new law that requires any sports gambling or fantasy.

Looney Would Shift Sports Betting Marijuana Capital Gains Taxes To Distressed Communities The Connecticut Examiner

Connecticut Betting Sites Legal Online Gambling Apps In Ct

Connecticut Sports Betting Handle Passes 1b Mark Even With Dip In Monthly Wagering

Va Betting Tax Gains After Change Bonusfinder Com

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

Connecticut Sportsbooks Open With 54 Million In October Bets

![]()

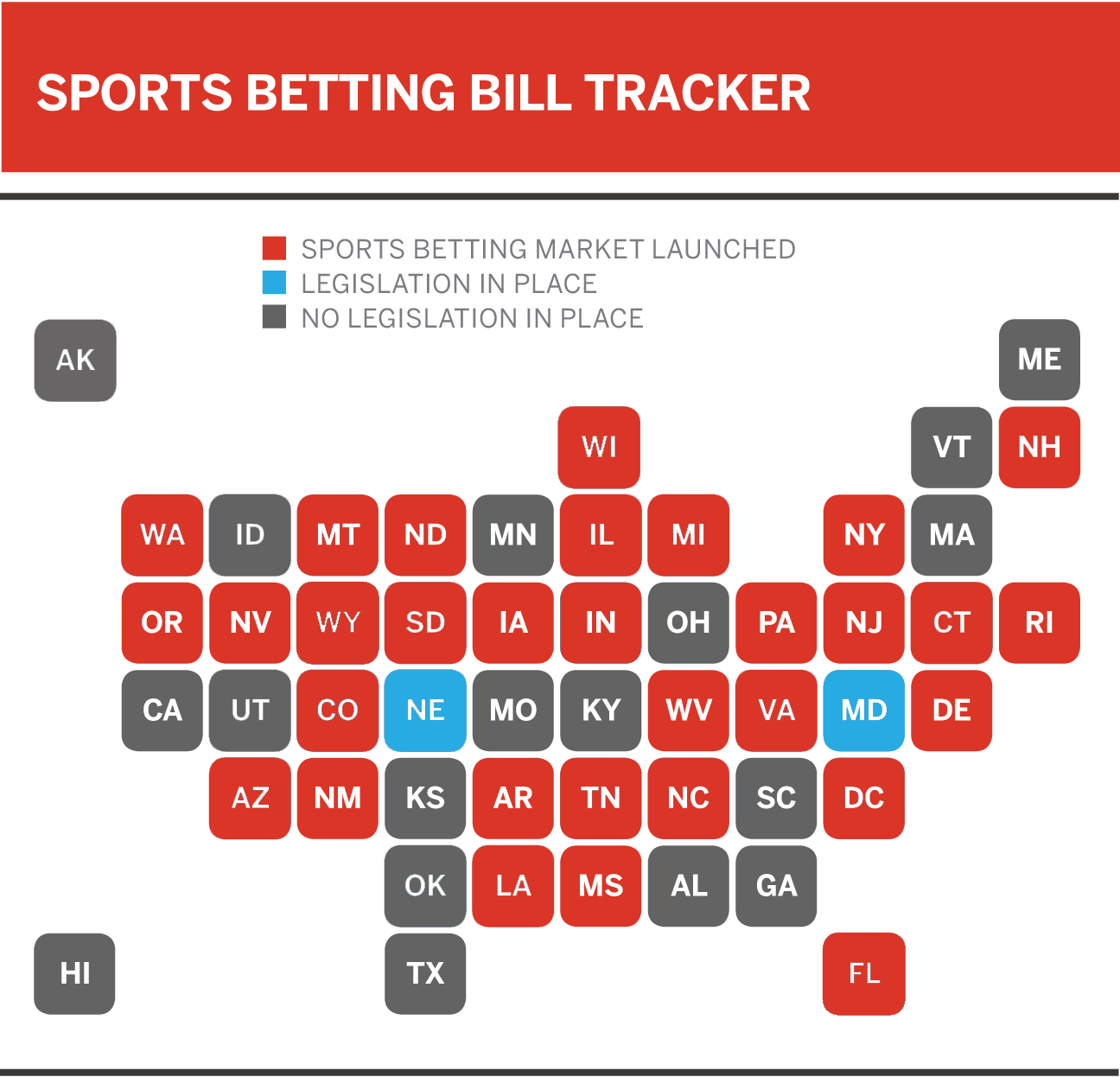

When Will My State Legalize Sports Betting Map Of Sports Gambling Legislation Across The Us

Three Tax Lessons From The First Year Of Widespread Legal Sports Betting Tax Policy Center

Peru Approves Law Regulating Sports Betting And Online Gaming Sets Net Win Tax At 12 Yogonet International

Ct Sports Betting To See Limited Launch This Week Fox61 Com

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

The United States Of Sports Betting Where All 50 States Stand On Legalization

Connecticut Keeps Adding Sports Betting Options Ny Sports Day

Online Sports Betting Is Changing Sports And The Gambling Business Graphic

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Connecticut Lawmakers Approve Sports Betting Here S When And Where You Can Place Bets

Connecticut Sports Betting Is It Legal Best Ct Betting Sites 2022